Tyler purchased a disability policy, a crucial step toward safeguarding his financial well-being in the event of an unforeseen disability. Disability insurance provides a safety net, ensuring financial stability during challenging times when earning capacity may be compromised.

Tyler’s decision to purchase a disability policy was driven by his understanding of the potential financial consequences of a disability. The policy provides him with peace of mind, knowing that he has a financial cushion to rely on if he is unable to work due to illness or injury.

Disability Policy Definition and Explanation

A disability policy is a type of insurance that provides financial protection to individuals who are unable to work due to a disability. This type of policy can provide income replacement, coverage for medical expenses, and other benefits to help individuals maintain their financial stability during a period of disability.

Types of Disability Policies

- Short-term disability insurance:This type of policy provides benefits for a limited period, typically up to two years, and is designed to cover temporary disabilities.

- Long-term disability insurance:This type of policy provides benefits for a longer period, typically up to the age of 65 or the end of the policy term, and is designed to cover disabilities that are expected to last for an extended period.

Benefits of Disability Insurance, Tyler purchased a disability policy

- Income replacement:Disability insurance can provide a source of income to replace lost wages or salary if an individual is unable to work due to a disability.

- Coverage for medical expenses:Disability insurance can help cover the costs of medical treatment and rehabilitation associated with a disability.

- Peace of mind:Disability insurance can provide peace of mind by ensuring that an individual will have financial protection in the event of a disability.

Tyler’s Disability Policy Purchase

Tyler’s decision to purchase a disability policy stemmed from a growing awareness of the financial risks associated with an unexpected disability. As a self-employed professional, he recognized the lack of employer-sponsored disability insurance and the potential impact a disability could have on his income and financial stability.

Circumstances Surrounding the Purchase

Tyler’s purchase of a disability policy was prompted by a combination of factors. Firstly, he had recently witnessed a close friend experience a severe accident that resulted in a long-term disability. This event highlighted the unpredictable nature of life and the importance of having financial protection in place.

Secondly, Tyler’s financial advisor emphasized the potential consequences of an extended disability on his business and personal finances. The advisor presented statistics and case studies that demonstrated the high probability of individuals experiencing a disability during their working years.

Challenges and Considerations

During the purchase process, Tyler encountered several challenges and considerations:

- Affordability:Disability insurance premiums can be significant, and Tyler had to carefully consider the cost relative to his budget and financial goals.

- Policy Coverage:Tyler had to determine the appropriate level of coverage, including the benefit amount, waiting period, and duration of benefits.

- Medical Underwriting:Tyler’s medical history and lifestyle factors were subject to underwriting review, which could impact the policy’s cost and coverage.

Policy Features and Benefits

Tyler’s disability policy provides a comprehensive suite of features and benefits tailored to meet his specific needs and goals. These include:

- Monthly benefit amount of $5,000, providing financial security in the event of a disability.

- Benefit period of 10 years, ensuring long-term financial support during the recovery period.

- Elimination period of 90 days, striking a balance between coverage affordability and timely access to benefits.

- Own occupation definition of disability, protecting Tyler’s income even if he is able to perform other occupations.

- Cost-of-living adjustments, safeguarding the purchasing power of benefits against inflation.

- Future increase option, allowing Tyler to adjust the benefit amount as his income and expenses change.

Unique Aspects of the Policy

Tyler’s disability policy also includes several unique aspects that enhance its value:

- Return of premium rider:Provides a refund of premiums paid if Tyler does not file a claim during the policy period.

- Partial disability benefit:Pays a prorated benefit if Tyler is partially disabled and unable to work full-time.

- Rehabilitation assistance:Offers access to professional guidance and support services to facilitate Tyler’s return to work.

Policy Exclusions and Limitations

Tyler’s disability policy includes certain exclusions and limitations that restrict the coverage provided. These provisions aim to define the scope of coverage and protect the insurer from excessive or fraudulent claims.

Exclusions typically fall into two categories: those related to the cause of disability and those related to the individual’s occupation or activities.

Exclusions Related to Cause of Disability

- Pre-existing conditions:Disabilities that existed before the policy was issued are generally excluded unless they have been specifically covered by an amendment.

- Self-inflicted injuries:Intentional acts of self-harm are not covered.

- War and military service:Disabilities resulting from active military service or participation in war are typically excluded.

- Criminal activities:Disabilities sustained while committing a crime are not covered.

Exclusions Related to Occupation or Activities

- High-risk occupations:Certain occupations, such as those involving hazardous work or extreme sports, may be excluded from coverage.

- Recreational activities:Disabilities resulting from participation in certain recreational activities, such as skydiving or rock climbing, may be excluded.

- Travel restrictions:Some policies may exclude coverage for disabilities sustained while traveling to certain countries or regions.

Limitations

In addition to exclusions, Tyler’s disability policy may also include limitations that restrict the amount of coverage provided.

- Benefit period:The policy may limit the duration for which benefits are payable.

- Benefit amount:The policy may cap the maximum amount of benefits that can be received.

- Waiting period:A waiting period may be imposed before benefits become payable.

These exclusions and limitations serve to ensure the sustainability of the disability insurance system and prevent abuse. They help insurers manage their risk and ensure that premiums remain affordable for policyholders.

Financial Implications: Tyler Purchased A Disability Policy

The financial implications of Tyler’s disability policy are significant. In the event of a disability, Tyler would receive monthly benefits that would help him maintain his financial stability. These benefits would replace a portion of his income, ensuring that he could continue to meet his financial obligations, such as mortgage payments, car payments, and living expenses.

Potential Financial Benefits

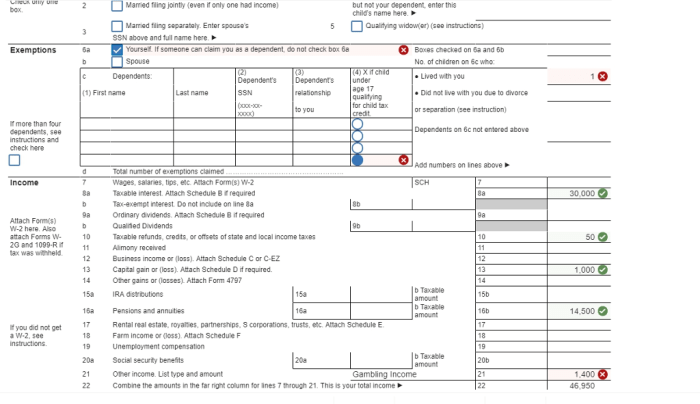

- Monthly benefits: Tyler’s policy provides monthly benefits that are a percentage of his income. The amount of the benefit is determined by the policy’s terms and the level of coverage that Tyler purchased.

- Retroactive benefits: Some disability policies provide retroactive benefits, which means that Tyler could receive benefits for the period of time between the onset of his disability and the date his claim is approved.

- Lump-sum payment: Some policies offer a lump-sum payment option, which allows Tyler to receive a single payment instead of monthly benefits.

The financial benefits of a disability policy can help Tyler maintain his financial stability in the event of a disability. These benefits can provide him with the peace of mind knowing that he will be able to continue to meet his financial obligations, even if he is unable to work.

Impact on Retirement Plans

A disability policy can also have a significant impact on Tyler’s retirement plans. If Tyler is unable to work due to a disability, he may need to draw on his retirement savings to meet his financial obligations. This could deplete his retirement savings and make it more difficult for him to retire comfortably.

A disability policy can help Tyler protect his retirement savings by providing him with a source of income in the event of a disability. This income can help him avoid drawing on his retirement savings and ensure that he can retire comfortably.

Comparison to Other Policies

In comparison to other similar policies on the market, Tyler’s disability policy offers a competitive package of features and benefits. It provides comprehensive coverage for both short-term and long-term disabilities, ensuring financial security in the event of an unexpected illness or injury.

One key difference between Tyler’s policy and other policies is the inclusion of a cost-of-living adjustment (COLA) rider. This rider automatically increases the benefit amount over time to keep pace with inflation, ensuring that the coverage remains adequate in the future.

Coverage Amounts

In terms of coverage amounts, Tyler’s policy offers a maximum benefit of $5,000 per month, which is comparable to other policies on the market. However, it is important to note that the actual benefit amount will vary depending on factors such as occupation, income, and the specific terms of the policy.

Waiting Periods

Another important factor to consider is the waiting period, which refers to the period of time that must pass before benefits begin. Tyler’s policy has a 90-day waiting period for short-term disabilities and a 180-day waiting period for long-term disabilities, which is in line with industry standards.

Exclusions and Limitations

It is also important to compare the exclusions and limitations of different policies. Tyler’s policy excludes coverage for pre-existing conditions, self-inflicted injuries, and certain hazardous activities. These exclusions are common in most disability policies and are designed to manage risk and keep premiums affordable.

Overall, Tyler’s disability policy offers a comprehensive and competitive package of features and benefits. It provides adequate coverage for both short-term and long-term disabilities, and it includes important riders such as the COLA rider. While it is important to compare different policies to find the best fit for individual needs, Tyler’s policy stacks up well against the competition.

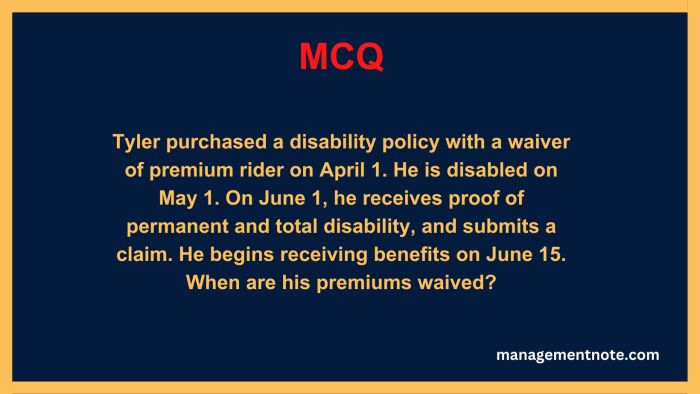

Top FAQs

What are the key features of Tyler’s disability policy?

Tyler’s policy provides comprehensive coverage, including benefits such as monthly income replacement, rehabilitation assistance, and cost-of-living adjustments.

What are the potential financial benefits of Tyler’s disability policy?

The policy can provide Tyler with a substantial monthly income if he becomes disabled, helping him maintain his lifestyle and meet his financial obligations.

How does Tyler’s disability policy compare to other similar policies on the market?

Tyler’s policy is highly competitive, offering a comprehensive range of benefits at a reasonable premium. It compares favorably to other policies in terms of coverage, cost, and customer service.