In today’s dynamic business landscape, a strategy of diversifying into unrelated businesses has emerged as a compelling option for companies seeking growth and resilience. This approach involves venturing beyond a company’s core competencies to explore new markets and industries, offering significant potential benefits and challenges.

Throughout this comprehensive guide, we will delve into the intricacies of diversification into unrelated businesses, examining its rationale, implementation, and measurement. By exploring case studies and extracting key lessons, we aim to provide a roadmap for businesses seeking to leverage this strategy for success.

Understanding Diversification into Unrelated Businesses: A Strategy Of Diversifying Into Unrelated Businesses

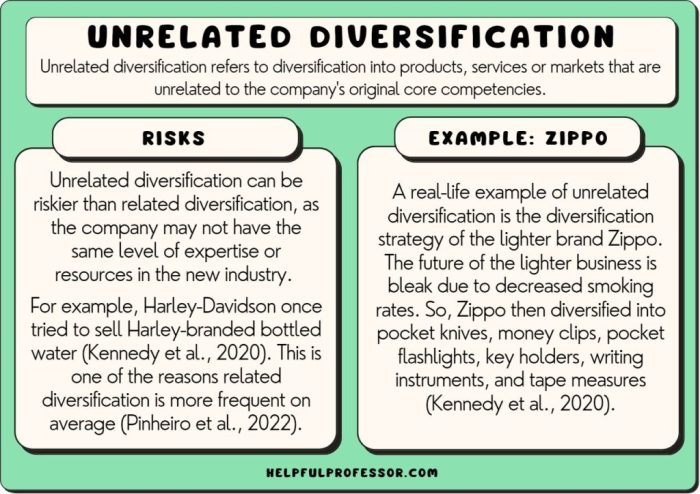

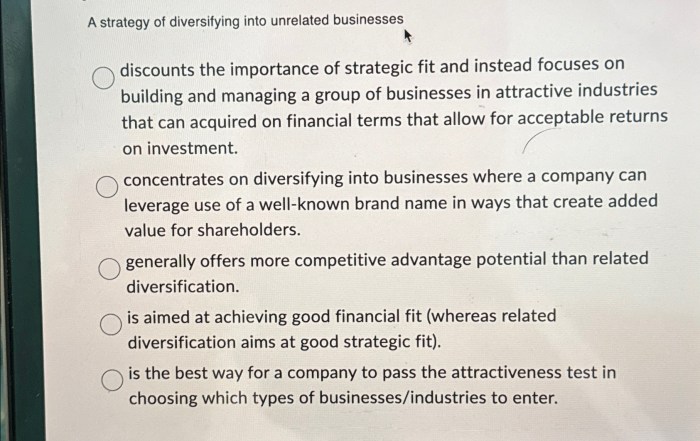

Diversification into unrelated businesses is a strategy that involves expanding into new markets and industries that are unrelated to a company’s existing operations. This approach aims to reduce risk and enhance growth potential by diversifying revenue streams and customer base.

Potential benefits include:

Risk reduction

By operating in different industries, companies can mitigate the impact of downturns or disruptions in any one sector.

Growth opportunities

Diversification allows companies to access new markets and capitalize on emerging trends, fostering growth and innovation.

Enhanced shareholder value

A diversified portfolio of businesses can increase shareholder value by providing a more stable and predictable revenue stream.Examples of companies that have successfully implemented this strategy include:

-

-*General Electric

Diversified from electrical equipment into industries such as aviation, healthcare, and finance.

-*Berkshire Hathaway

Expanded from insurance into a wide range of businesses, including energy, manufacturing, and retail.

-*Amazon

Started as an online bookstore and has since diversified into cloud computing, e-commerce, and entertainment.

Quick FAQs

What are the primary benefits of diversifying into unrelated businesses?

Diversification can reduce risk by spreading investments across different industries, provide access to new markets and revenue streams, and enhance overall financial performance.

What are some examples of companies that have successfully implemented a strategy of diversification?

Notable examples include General Electric, Berkshire Hathaway, and Virgin Group, which have diversified into a wide range of industries, from healthcare to entertainment.

What are the key challenges associated with diversifying into unrelated businesses?

Challenges include managing different business units effectively, integrating new acquisitions, and overcoming cultural and operational barriers.